Online fashion, otherwise known as Fashion-tech industry, regards all the digital innovations that can change existing processes or business models in the fashion system.

Digital economy is producing an incredible impact on this industry, and we have seen several disruptive outcomes so far, quite new online platforms or marketplaces have now a much higher traffic and sales than established and long-standing global brands.

But how much this wave, born around years 2000 and exploding today, has been perceived as an attractive opportunity by investors such as venture capitalists? The further question is: how much this disruption has been perceived by established brands, and how are they acting or reacting?

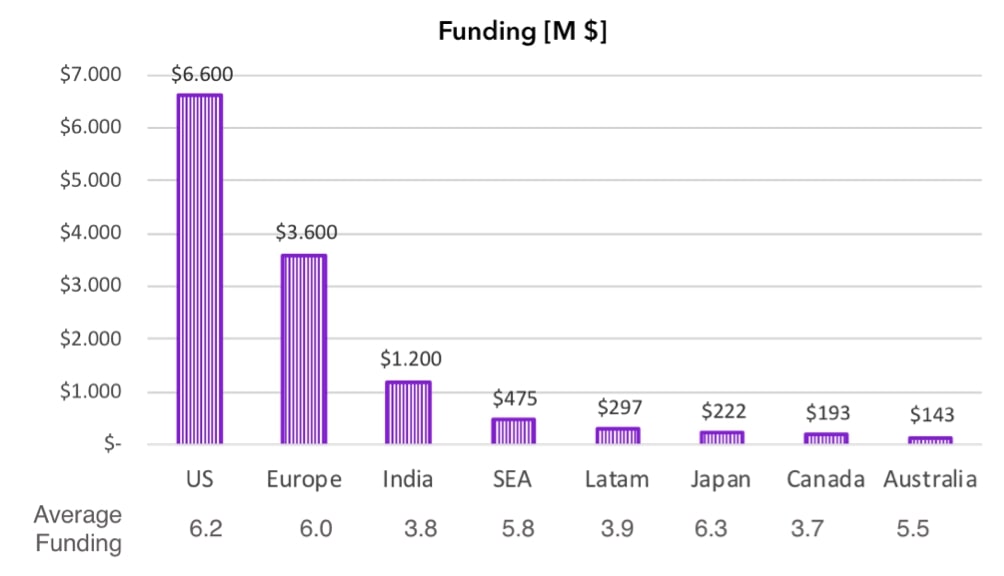

The Fashion-tech industry has attracted in the last seven years (2011-2017) more than 10 Billions $ (Source: Fashion Tech Tracxn Sector Report, May 2018). To have a reference, if we consider the food-tech industry, for instance, in 2017 the total amount of it was 880 M$ while for Fashion-tech 1.600M$, hence the latter is almost doubling the former.

In terms of geographical distribution, US confirm to be leader investor in technology, also when this is applied to the Fashion industry, more than doubling the amount invested by European investors. Also, India is emerging as the third most represented area.

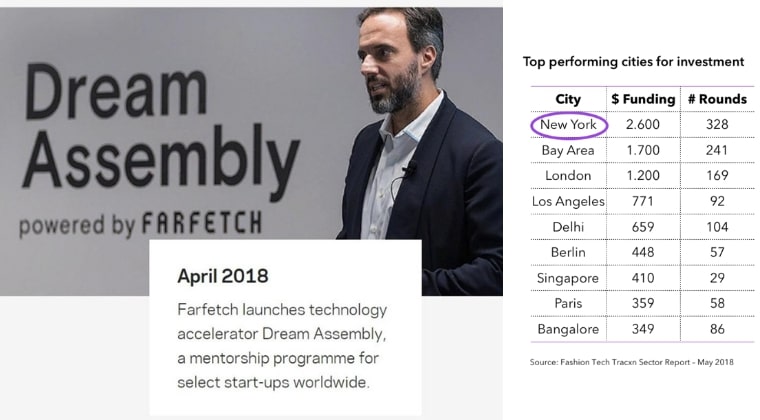

At a city level, New York is the most active city in fashion tech investments. Milan is lagging behind other fashion capitals such as London and Paris, in terms of investment in this sector. Again, India is exploding, showing both Delhi and Bangalore among the top 10 performing cities in the investment area.

In terms of sectors, e-commerce platforms are the ventures receiving larger amount of investment, and this is not surprising, since many of those former start-ups have now grown successfully to become unicorns, such as Farfetch, Zalando, Warby Parker, Global Fashion Group, etc.

More surprisingly, two sectors as second-hand and rental platforms are also attracting large amount of investments, showing how investors are betting in a radical shift of the way of consuming fashion items. Most of the startups in these two sectors are based in Silicon Valley, where customers are more prepared to switch their behavior.

The interest in investing in digital innovative startups is lower in the corporate sector if compared to venture capital funds, but increasing. In particular, there are four categories of corporations that are more active in this market.

Department stores: the crisis of the retail chains especially in USA is pushing those organizations to invest in new solutions to attract their customers to the stores. For instance, Westfield has launched a corporate accelerator that gives funding and mentoring to startups in the retail tech, Galeries Lafayette has launched an accelerator focused on technologies to renovate the retail concept.

Fast fashion corporate: being identified as one of the categories responsible for the sustainability issues in the fashion industry, they are investing in activities to improve their impact on the environment. In this line, H&M through the H&M Foundation has launched the Global Challenge Award to support the most innovative startup with sustainability contents. Or C&A Foundation launched Fashion for Good to accelerate the access to the market to startups innovating the fashion industrial processes with sustainability approaches.

Luxury conglomerates: they invest in innovative startups to keep their leadership also on innovation, also they have the managerial structure to define and execute a long-term vision about innovation. Kering group has sponsored an acceleration program with externals partners, to invest in sustainability-based solutions. LVMH has launched a venture fund to invest in growth stage startups in the luxury segment.

E-commerce-based platforms: those are former startups that perfectly understand the need to continuously invest in technology to stay on the edge and to keep their competitiveness. Farfetch launched Dream Assembly, a tech and retail accelerator that offers a program of education, mentorship, early-stage funding and networking to promising startups that operate in the field. Vente Privée launched Impulse, a nine-month acceleration program, as part of their ambitious R&D plan, to support European start-ups involved in assisting and spurring changes in e-commerce.

Giusy Cannone is Chief Executive Officer of Fashion Technology Accelerator.

She is the reference point for FTA’s corporate projects, also creating business connections for startups in the Acceleration Program and mentoring participants of our Masterclasses,